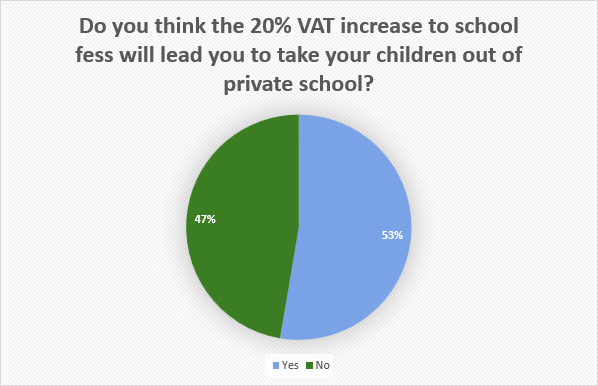

52% of parents planning to take their children out of private schools

Our recent poll suggests that 52% of parents will take their children out of private schools once the 20% VAT on school fees come into effect from January 2025.

In numbers, the potential effects of 52% pupils leaving private school education

- This would amount to over 300,000 excess pupils moving to state school.

- The added cost to government would be 1.5bn per year (with a cost of £5,000 per pupil).

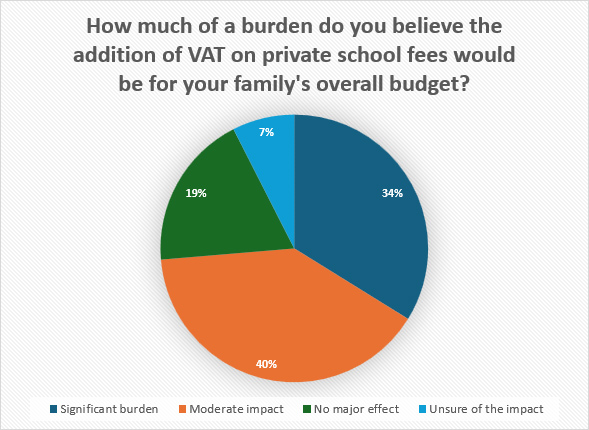

Over a third have stated that the addition of VAT to school fees would add a 'Significant burden' on their family's overall budget.

Let's be clear about one thing - education is for the public good, regardless of how it is funded. This means education is a good that, whilst produced for the benefit of one person, will inevitably go on to improve the lives of many other people. For example, an educated individual contributes towards a skilled national work force, which in turn contributes to an increase in tax revenue for the government; but most importantly for any government, or society at large, contributes proportionately more to Gross Domestic Product (GDP).

On the question of sound financial sense, 20% VAT on private school fees is projected to raise £1.6bn1 per year for the Treasury, a not insignificant sum. Labour's tax increases will very likely incur costs for the government though: a recent poll of 600 parents conducted by Tutor Hunt has revealed 52% of parents will be looking to remove their children from private schools when the added VAT comes into force from 1st January 2025.

This means 300,000 pupils moving from the private to the state sector. With each pupil costing around £5,000 per year to educate, this amounts to a combined cost of £1.5bn per annum. Simple arithmetic leaves us with a mere £1m extra in the hands of the Treasury to spend on 'more teachers'. Therefore the added VAT on private school fees hardly seems to make financial sense for the government, with any savings reaped being but a drop in the ocean; and that is before we even get to accounting for the benefit to GDP private education consumption provides.

The 20% VAT rate will be added to private school fees from the 1st January 2025 "to better invest in state education", according to the Department of Education. However many private schools are predicting an exodus of pupils, with at least one school having already closed as a result of the increased fees. St Joseph`s Preparatory School in Staffordshire announced in early September that it will be shutting at the end of the year due to "financial challenges".

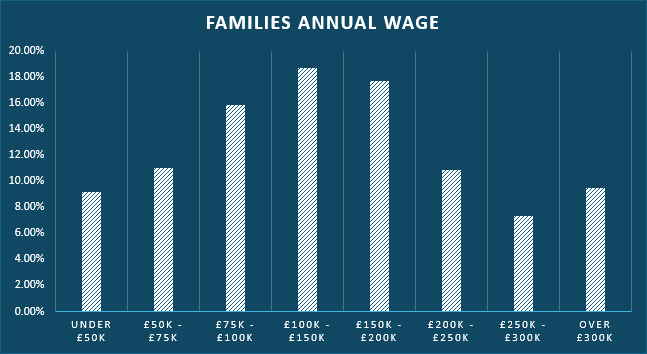

Private school fees have already seen an increase of 20% in real terms since 20102 and for those parents funding fees through income, not intra-generational wealth, an additional 20% VAT on fees, will be a deal breaker. These same parents have already disproportionately absorbed the wider national cost crisis in terms of their mortgage rates, tax burden, and inflation on basic goods and services, all the while striving for betterment of outcomes for their children. This opens the wider question of whether we should be taxing ambition amidst another national crisis, the productivity crisis.

To understand the sentiment amongst such parents, take the example of a state educated parent who strived at school themselves, while those around her got lost in a failing state school system. She worked hard, got a job in which she excelled, and consequently is now paid above the national average. She now contributes a proportionately higher amount of tax to the state coffers. However, she chooses to consume the public good that is private education for her own children, given her firsthand experience of the state education system, rather than feel entitled to material luxuries such as holidays or cars, all of which she is perfectly within her rights to consume, albeit with no public benefit attached. She is now taxed an additional 20% on striving and consuming a public good, rather than luxuries, with no associated positive externalities for the wider society.

The alternative for this parent would have been for her to purchase a house in the right postcode to educate her child at a 'good' state school. She is now however priced out, with houses in the vicinity of good state schools have costing more than those outside the catchment area. The introduction of VAT on private school fees will only drive-up house prices in these areas, concentrating wealth in even fewer hands.

You may say she has a third alternative: chose her local state school to educate her children. But why would she? She went to one herself and was lucky to survive it intact. As a nation we need to have a serious debate about how we raise, and pay for, standards to be raised in an impactful way across the state education system. This will make the state education system an easy choice for most, including ambitious parents, and naturally weed out a significant portion of demand for private education.

We need to stop tinkering at the edges with these vote winning - some may even say gimmicks - such as charging VAT on private school fees, as well as quit blaming tertiary education and ambitious parents for successive governments repeated policy failures in the compulsory education space.

You may argue this VAT on school fees is a start to financing this improvement in state education standards, but it doesn't go far enough, nor raise nearly enough funding to be impactful. Therefore, this paper concludes the 20% VAT on private school education is, in the main, a vote winner. Vote winners: the price we pay to maintain the benefits of democracy.

1 Institute for Fiscal Studies (IFS) 2 Institute for Fiscal Studies (IFS)

Add a Comment

Add a Comment